Pakistan will issue its own digital currency by 2025 - Crypto weekly update

Published: 09. 04. 2019 ·

Every week Crowdamerica.org brings you a recap of the most valuable crypto-news from fields of Technology, Legal & Politics, Business, and Media. So stay tuned and buckle up for some good reading.

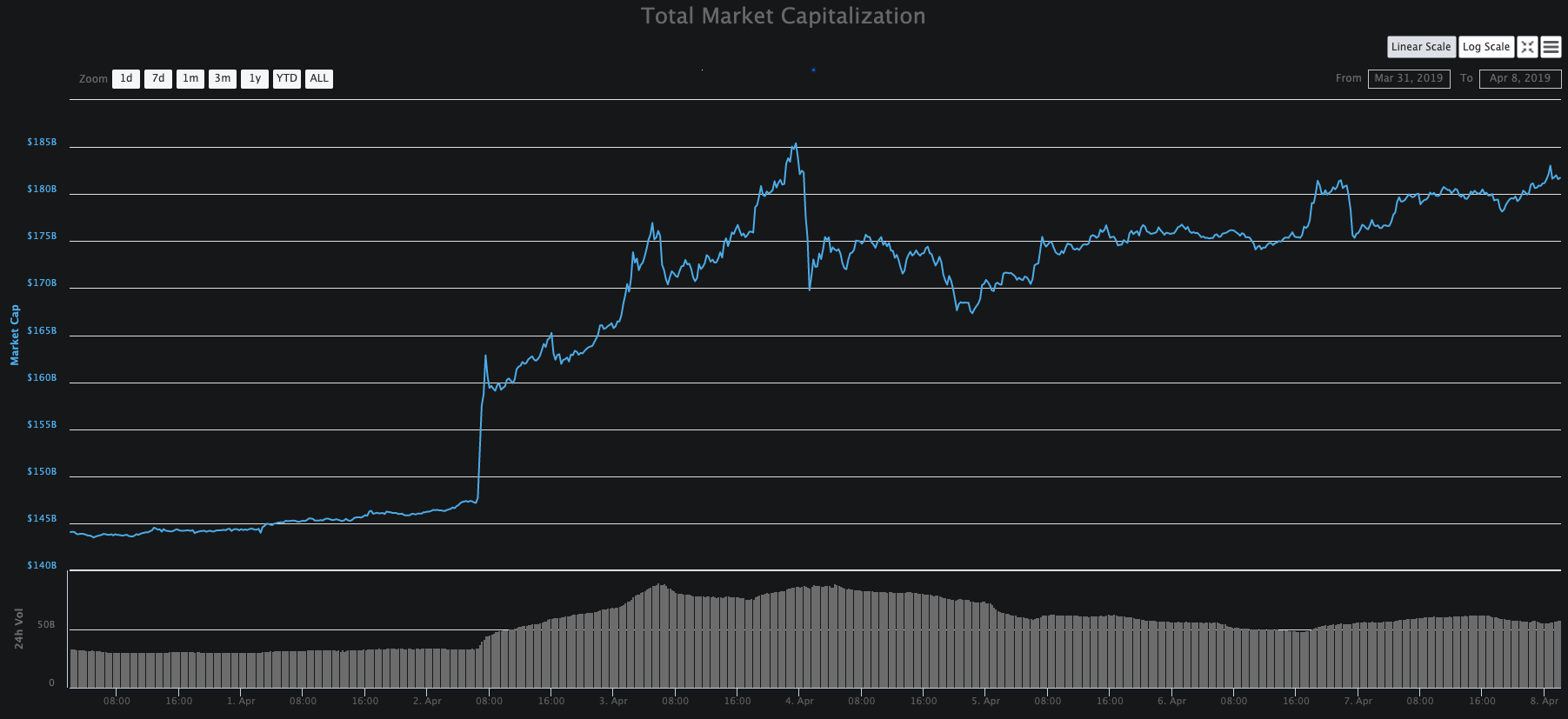

New milestones continue to be set in 2019 following the recent 2019 all-time high trading volume being set just last week, followed shortly by a new 2019 all-time high bitcoin price when BTC broke over $5,000. The market capitalization reached just short of $186 billion, a new 2019 all-time high. The market capitalization saw massive growth this past week following a surge in cryptocurrency prices, including bitcoins massive climb to over $1,000 in the space of a few days. The market appears to have gained some bullish momentum as prices held firm into the second week of April. The bitcoin weekly close was one of the strongest seen in weeks. Before you continue reading learn something about Crowdamerica.

I. Technology

Austria’s largest energy provider, Wien Energie, has developed a blockchain-driven fridge in partnership with tech giant Bosch, Cointelegraph’s correspondent reported from the ANON Blockchain Summit Austria. Wien Energie presented the new model during the crypto conference in Vienna on April 3. The official release claims that decentralized technology is used in the construction of a refrigerator for the first time.

The main goal behind the project is to increase consumer interest in the sustainable consumption of energy. A blockchain solution, in this case, allows one to choose the source of the energy, be that a solar panel or a wind power plant. Each kilowatt used by the fridge can be traced to its origin, the release reads. Moreover, the blockchain fridge can be fully operated via smartphone. A user is able to control the temperature of the fridge and freezer, check whether the door is properly closed, and trace the energy consumption and CO2 emissions. According to the official statement, the model is not yet on sale. Wien Energie and Bosch will first test the blockchain fridge with three pilot customers in the coming months. Wien Energie CEO Peter Gönitzer considers blockchain a great opportunity to reduce the unnecessary waste of energy, the release notes. According to him, the decentralized ecosystem could contribute to creating a transparent and user-friendly energy market. cointelegraph.com

TRON Preparing to Launch Layer-Two Solution, SUN Network for Faster Transactions: Justin Sun, the founder of Tron (TRX), a leading platform for building smart contract-enabled decentralized applications (dApps), has revealed that the SUN Network is “almost” ready to go live. The crypto entrepreneur noted that the SUN network consists of sidechains and a “cross-chain infrastructure” that will allow the Tron platform to “further expand [its] overall capacity.” According to Sun, the updates to Tron’s blockchain will “improve the [network’s] overall” ability to process transactions. The codebase modifications will also enable more efficient “smart contract execution,” Sun stated. Some important upgrades that will be activated on the Tron network include the launch of a DAppChain. This has been described as a DApp “sidechain expansion project” which aims to “significantly increase the capacity” (or throughput) of dApps running on the Tron platform. DAppChain has been built to allow users to “run dApps with extremely low energy consumption, high security, and efficiency.” As noted in Sun’s tweet, there will be “three phases” through which DAppChain will be introduced. The software will be rolled out in phases in order to provide a seamless UX/UI experience and allow users to test the DAppChain platform before it is launched into production. www.cryptoglobe.com

II. Legal & Politics

Global debt now stands at a terrifying $243 trillion according to a report by the Institute of International Finance this week. That’s quarter of a quadrillion. We’re in the realms of the absurd. This is unsustainable. And it’s the fault of a broken and irresponsible monetary system, addicted to printing money and issuing credit. It’s time to admit we need a new alternative. While it’s far from perfect, bitcoin offers a viable solution with its fixed supply and regulated output. It’s time for a revolution. The record figure stands at three-times the world’s total gross domestic product (GDP). In other words, it’s three times larger than the value of all products and services on the planet. The figure peaked in the first quarter of 2018 when it hit $248 trillion. It has since fallen back slightly. The US is among the biggest offenders. As CCN reported, total US national debt hit $22 trillion this year. Nonfinancial corporate debt in the US is now close to its pre-2008 crisis highs. On the surface, credit can help spur growth. Governments, companies, and individuals borrow money to fund economic development. The problem comes when it doesn’t work. When there’s not sufficient growth, we borrow more. And more. As John Mauldin writes in Forbes: “This is classic addiction behavior. You have to keep raising the dose to get the same high… Central banks enable debt because they think it will generate economic growth. Sometimes it does. The problem is they create debt with little regard for how it will be used.” Bitcoin’s fixed supply is an antidote to central banks’ addiction to printing money and encouraging debt. Only 21 million bitcoin will ever exist. And they’re created according to a strict output cycle, regulated by math. The supply cannot be manipulated or increased according to the whims of any one government or bank. As ShapeShift CEO Erik Vorhees explains, when the rising debt mountain implodes, people will flock to crypto in their hordes. When the next global financial crisis occurs, and the world realizes organizations with $20 trillion in debt can’t possibly ever pay it back, and thus must print it instead, and thus fiat is doomed… watch what happens to crypto. Bitcoin offers a sharp contrast to the fiat system. In our fiat system, central banks create money out of thin air in a process called quantitative easing. In simple terms, the central banks issue new money and use it to buy bonds and assets. This has the effect of introducing more money into supply, lowering the purchasing power of your money, and encouraging low-cost lending. And when one country uses QE and low-interest rates to spur its economy, others inevitably do the same. It creates a race to the bottom where every country is flooding its economy with cheap money to stay competitive. The result is a mountain of unsustainable $243 trillion debt — something most people don’t even know exists. It’s time for a new system. As Henry Ford said: “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” www.ccn.com

The European Union announced the launch of the International Association of Trusted Blockchain Applications (INATBA) on its official website on April 3. According to a Cointelegraph representative who attended today’s ceremony at the European Commission in Brussels, the more than 100 members who have signed the charter include IBM, Accenture and Deutsche Telekom. Among the blockchain-related members number Iota, Ripple, ConsenSys, and the Sovrin Foundation. Per the announcement, INATBA aims to bring together industry startups, small and medium enterprises (SMEs), regulators and standard setting bodies to bring blockchain and distributed ledger technology (DLT) into the mainstream. During the Brussels ceremony, European Commissioner for Digital Economy and Society Mariya Gabriel noted that the EU is committed to fostering the development of blockchain. She said:

“In today’s economy, there is less and less time to build trust in the way it happened in the past. To fight cancer, to balance renewable energy, to trace the authenticity of goods, actors must be able to trust one another without meeting face-to-face. And how can we achieve this? Of course, with the help of blockchain.” cointelegraph.com

Pakistan Will Issue Its Own Digital Currency By 2025: According to the Dawn, a local media outlet, Pakistan’s central bank has announced plans to have a digital currency by 2025. Speaking about the regulation of Electronic Money Institutions, non-bank entities that will be allowed to issue “e-money” for digital payments, Pakistan’s State Bank Deputy Governor Jameel Ahmad told the audience that digital currency is more efficient. He also called on the government to ensure that cybersecurity was a top priority moving forward so that Pakistanis can fully take advantage of recent innovations. While the Pakistani government has given itself a long window to create an “e-rupee,” private entities will be able to build digital solutions in the meantime. Ahmad said: “It is our government’s policy to encourage the use of e-commerce amongst public through awareness campaigns to promote a culture of e-commerce, which supports electronic business transactions at national, regional and international levels.” Pakistan’s last great financial innovation, according to the Dawn, was the legalization of web banks or “branchless banking.” The next step is allowing non-banks to participate in the facilitation of payments, which provides a framework for blockchain companies to apply for regulatory approval. The central bank intends to launch its digital version of the country’s Rupee, but not many more details have emerged regarding that. The entire world is moving towards a cashless state. Ahmad spoke to the success of branchless banking: “Over the past few years, branchless banking providers have evolved well and are now offering financial services to a large segment of our population.” In some ways, Pakistan was ahead of many other countries in terms of mobile banking solutions and even received praise from the World Bank some years back. www.ccn.com

III. Media

Swiss Alps 5-Star Hotel is Switzerland’s First Luxury Hotel to Accept BTC or ETH: Switzerland’s five-star hotel The Dolder Grand has announced that guests can now settle their bills in bitcoin or ether. In a tweet, the Zurich-based luxury hotel announced it was the first facility of its kind to accept cryptocurrency payments. We are very proud to have taken a step towards accepting cryptocurrency. The Dolder Grand is the very first luxury hotel in Switzerland where guests can pay with Bitcoin. The crypto payment feature is being facilitated by fintech firm Inacta. The fintech firm has developed an app that allows guests to pay for hotel services from their bitcoin wallets. Bity, a Swiss cryptocurrency exchange, will convert the cryptocurrencies into fiat currencies. In future Inacta will extend the number of cryptocurrencies that customers can pay in. According to Inacta’s blockchain advisory head, Roger Darlin, the app is targeting ‘hodlers’: It is aimed at customers who have built up legitimate cryptocurrency holdings and who don’t want to convert them into traditional currencies, such as Swiss francs. This also allows vendors, who may be cautious about handling cryptocurrencies directly, to accept payments from these clients. This coincides with Fortune 500 firm Avnet revealing it is accepting crypto payments after partnering with crypto payments firm BitPay. www.ccn.com

Russian Social Media Giant Vkontakte Launches ‘Mineable’ Virtual Currency: Russian social media giant Vkontakte (VK) has reportedly launched its own virtual currency, dubbed VK Coin. It’s currently unclear whether it’s a blockchain-based cryptocurrency or merely a digital currency used on its platform. The launch follows reports that suggested the social media giant founded by Pavel Durov was going to launch its own cryptocurrency, which could be integrated into its own payments system called VK Pay. According to local news outlet Tass, VK’s new digital currency can be ‘mined’ by the platform’s users via a mobile app game. After earning VK Coins, users can then send them to others or accumulate them. The game has a top winners list based on VK Coin holdings. The app is reportedly available on both iOS and Android devices. VK Coins can also be used to boost mining speed and will be usable pay for services within VK itself. A post from the company’s VK Pay service notes external partners may also join in. The post reads (roughly translated) “And this is not empty fun — in the “Store” tab in VK Coin you can soon exchange coins for offers from partners. The first will be available coupons for discounts from 5 to 20% when ordering in the Delivery Club. Who knows, maybe there will be other lucrative promotions?” As of this week, the social media giant’s virtual currency has reportedly been used by over 4 million users, with the richest one having already mined 890 million coins. Some reports suggest users have already started exchanging VK Coins for services on VK. Vkontakte is notably Russia’s largest social media network, with over 97 million active users per month, and 6.5 billion messages exchanges per day. It was launched as a local competitor to Facebook, a social media giant that is reportedly going to launch its own cryptocurrency. Some have suggested Mark Zuckerberg’s firm has already reached out to cryptocurrency exchanges to get Facebook’s coin listed on their platforms. The launch of such a coin, according to one Barclays analyst, could bring Facebook over $19 billion in revenue. www.cryptoglobe.com

How to Save Over 15% Shopping on Amazon With Bitcoin Cash? There’s an ever-growing list of places on the web where you can spend Bitcoin Cash (BCH). However, Amazon stands out as an online retail giant that dominates many markets. Today’s tip explains how to shop on Amazon using bitcoin cash while claiming a great discount to boot. Purse.io is a platform that offers significant discounts for cryptocurrency users on products sold on Amazon. Users can search for any item they want to purchase and select a discount of 5 percent for fastest delivery times or they can name their own discount at the expense of speed. According to the site’s statistics, the company facilitated over 300,000 orders during 2018 with an average discount of 18 percent. The platform essentially works by connecting crypto shoppers with people who wish to exchange their Amazon gift cards for the cryptocurrency. This also means that in addition to shopping on Purse.io, you can use the platform to purchase bitcoin cash with any Amazon gift cards you may have, something that is not possible on exchanges. news.bitcoin.com

Union Bank is rolling out its first crypto-enabled ATMs in the Philippines. This is in response to increasing demand from the institution’s clients, as reported by Business World. Union Bank was first scheduled to launch these two-way crypto cash machines back in February, after receiving approval from the Asian nation’s central bank, which is one of the world’s more crypto-friendly monetary authorities. After a delay of several months, the first ATM is now active in Union Bank’s digital branch The ARK, located in Makati City. It is only available for customers of the bank, who must already have a crypto wallet set up. They will be able to withdraw cash straight from their bank account, as well as buy and sell cryptocurrencies on the spot.The ATM technology was developed by financial technology firm Coins.ph. There are now around 4,500 crypto ATMs installed worldwide, with the U.S. leading the way in terms of adoption. Most deal only with Bitcoin (BTC), but an increasing number are offering support for altcoins, including Litecoin (LTC) and Dash (DASH). www.chepicap.com

IV. Business

Jamaica’s National Stock Exchange Will Pilot Bitcoin and Ethereum Trading: In a further sign of the blurring of the lines between crypto and mainstream assets, it will soon be possible to trade bitcoin on the Jamaica Stock Exchange (JSE). The exchange which was founded five decades ago has inked an agreement with Canadian fintech firm Blockchain that will ‘enable live trading of digital assets and security tokens in a regulated and secure environment’, according to a statement. Under the agreement, Blockstation will offer the end-to-end crypto trading platform for JSE’s network. This followed a test-run in which the broker-dealer members of the JSE participated. JSE’s subsidiary, the Jamaica Central Securities Depository, also took part in the pilot phase. According to the JSE’s managing director, Marlene Street Forrest, the development will allow the stock exchange to ‘diversify its product offerings’. Additionally, it will allow the JSE to ‘attract new listings and inbound investments’. www.ccn.com

The G20 member countries are due to meet in June to discuss crypto regulations. Representatives will get together in Japan in order to establish a framework that will help to tackle money laundering. The meeting will take place on June 8 and 9 in the city of Fukuoka, as reported by local news outlet Kyodo. It will be part of the annual Finance Minister and Central Bank Governors meeting. Anti-money laundering (AML) remains a key issue for most national regulators when it comes to cryptocurrency. Crypto trading platforms are being increasingly encouraged to adopt stringent know-your-customer (KYC) policies in order to prevent the origin of funds being hidden through the use of cryptos such as Bitcoin (BTC) and privacy coin Monero (XMR). As well as criminal organizations, rogue states are also suspected of making use of crypto in order to circumvent international economic sanctions. The country itself will apparently not be mentioned by name at the meeting, but cracking down on North Korean state-sponsored cybercriminals who often steal crypto in order to help fund the regime, will be a priority for the G20 members. www.chepicap.com

Western Union, an American financial service firm has now entered into a partnership with e-wallet provider Coins.ph, a Philippine-based firm. The partnership will allow Filipinos to perform cross-border money transfers. The news was published on April 3. Western Union continues to make progress in the field of cryptocurrency by entering into the field. This is the most recent step taken by the financial firms in crypto space. Western Union selects Coins.ph as its partner to offer blockchain based services. Coins.ph is a blockchain based financial services firm with a mission to help people who do not have bank accounts. Besides also offers a way to make crypto purchases. Mobile wallets and services like remittances, bill payments and mobile air-time are the services offered by Coins.ph. The cross border platform of the Western Union will enable Filipinos to receive and hold international money transfers activated from the digital network of Western Union in 60 plus countries and retail network across more than 200 countries and territories. The Philippines can receive and hold international money transfer straight into their Coins.ph wallets. Co-founder and CEO of Coins.ph Ron Hose said: “There are many overseas Filipino workers who send money back home regularly and are always looking for additional remittance options that will make it most convenient for their loved ones to receive money.” www.cryptonewsz.com

A Millennial and Crypto Love Story: How This Generation Is Ghosting Banks

America’s youth has long been in a bad relationship with banks. Their predatory, self-serving practices have left a bad taste in the mouths of many young consumers, who have historically acclimated and resigned themselves to the system as they aged. Millennials have been accused of killing almost every industry, from golf to napkins, but now they’re on the cusp of the biggest breakup yet — with banks. Millennials might finally be the generation to leave their deadbeat ex and have the passion and optimism to envision a new way of doing things financially. During the 2008 financial collapse, the Fed had to lower interest rates to 0 percent, right around when millennials were graduating from college (in debt from bank loans) and trying to build up their finances. Millennials could barely earn interest on their deposits, while banks continued to use those same deposits to charge consumers 25 percent interest on credit cards and keep over 90 percent of the value to themselves. Bank executives have had record earnings and bonuses since 2009, while most Americans struggle to finish the month in the green. This is a completely one-sided relationship, with millennials giving and banks taking. Besides, healthy relationships are based on trust, and millennials just don’t trust banks. According to a 2018 study by Edelman, 77 percent of affluent millennials feel the traditional financial system is “designed to favor the rich and powerful.” 75 percent worry about the global financial system being hacked and losing their personal information, and 77 percent think it’s a matter of time before finance’s “bad behavior” leads to “another global financial crisis.” So banks are bad news, and they don’t even pretend not to be. 70 percent of affluent millennials feel that financial service companies “make the purchasing process unnecessarily confusing/frustrating” and 71 percent say these companies leave them feeling “unsure” and “out of their depth.” This is a recipe for an unstable, manipulative relationship. Luckily, millennials have the sense to realize that and pull the plug. The millennial disruption index slates banking as the ripest industry for disruption, and reports that 71 percent of millennials would rather go to the dentist than “listen to what their banks have to say.” On top of all of that, banks have historically proved to be ageist, racist, and classist institutions that disfavor minorities in lending practices, fail to provide services to minority neighborhoods and provide predatory rates to populations most in need. This is no pesky lovers’ quarrel. This is a breakup. Luckily, cryptocurrency is waiting to be that shoulder for millennials when banks break their hearts … and their wallets. It didn’t take long for millennials to notice — 17.2 percent of millennials own crypto already. And that number is higher for wealthy millennials: According to Edelman’s study, 25 percent of wealthy millennials own cryptocurrencies, a further 31 percent are interested in crypto, and a whopping 74 percent say technical innovations like blockchain make the global financial system more secure. news.bitcoin.com